Average deductions from paycheck

However they dont include all taxes related to payroll. FICA taxes consist of Social Security and Medicare taxes.

What Is Casdi Employer Guide To California State Disability Insurance Gusto

How Your Indiana Paycheck Works.

. Theres a shortfall of 50 in your till and your employer wants to deduct this from your earnings. Any income exceeding that amount will not be taxed. The amount of federal taxes taken out.

If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes. You pay the tax on only the first 147000 of your earnings in 2022. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

You need to save 5 of every paycheck if you start at age 25. Employers withhold or deduct some of their employees pay in order to cover. The average marginal tax rate is 259 while the average tax rate is 169 as stated above.

The IRS receives the federal income taxes withheld from your wages and puts them toward your annual income taxes. This means the total percentage for tax deduction is 169. The money also grows tax-free so that you only pay income tax when you.

For instance if you get paid bi-weekly and are a full-time hourly. Gross pay is the total earning before any deductions. Youre paid 250 gross per week.

FICA taxes are commonly called the payroll tax. Youd pay a total of 685860 in taxes on 50000 of income or 13717. It can also be used to help fill steps 3 and 4 of a W-4 form.

The amount withheld per paycheck is 4150 divided by 26 paychecks or. Paycheck Tax Calculator. Your employer can take 10 of your gross earnings which.

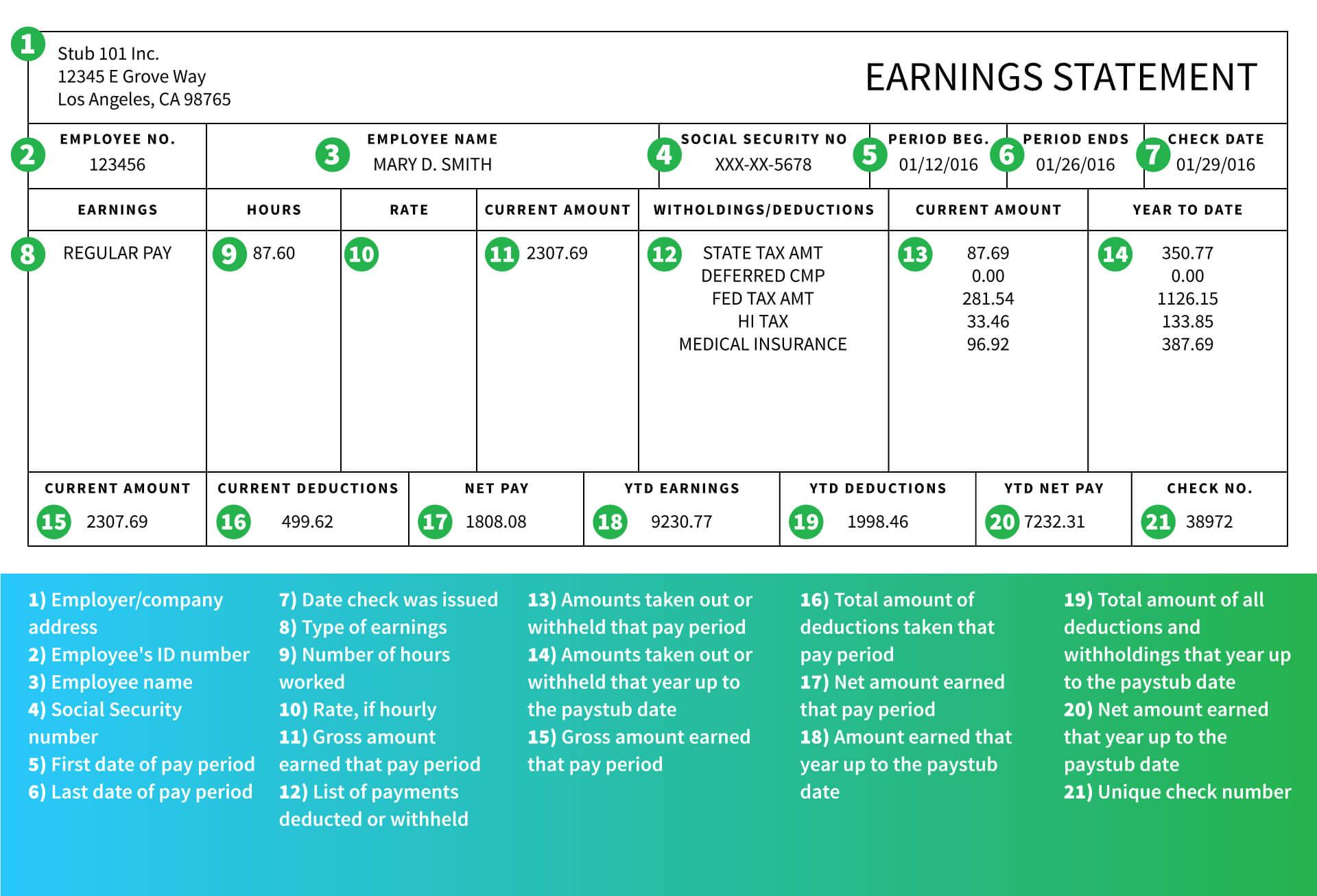

You can use a paystub generator to better visualize how these deductions work. Your effective tax rate is just under 14 but you are in the 22. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Additionally the FICA and State. This may be necessary if you are self-employed as a paystub showing deductions is an. State sales tax rates.

The Social Security tax is 62 percent of your total pay. For Medicare taxes 145 is deducted from each. 22 on the last 10526 231572.

Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. In addition to federal income tax you will also have to pay state income tax and any other local income taxes like those for city or county governments.

This will help determine your withholding when completing a W-4. You need to save 10 if you start at age 35 22 if you start at age 45 and 52 of every paycheck if you start.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Here S How Much Money You Take Home From A 75 000 Salary

Pay Stub Meaning What To Include On An Employee Pay Stub

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

What Are Itemized Deductions And Who Claims Them Tax Policy Center

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

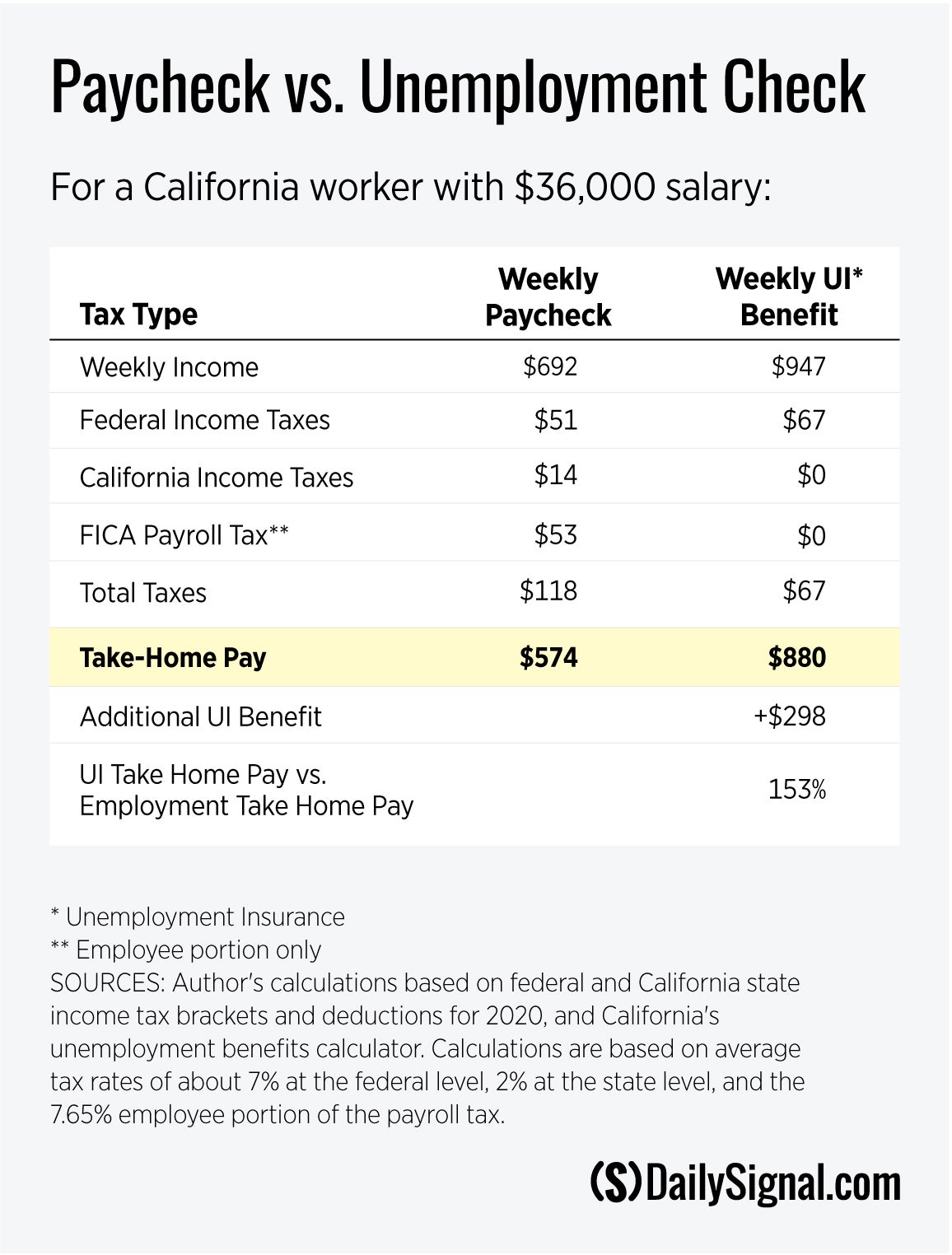

As Unemployment Keeps Rising Congress Needs To Fix What It Broke The Heritage Foundation

Different Types Of Payroll Deductions Gusto

Check Your Paycheck News Congressman Daniel Webster

The Real Numbers In Your Paycheck Southpoint Financial Credit Union

How To Read A Pay Stub Gobankingrates

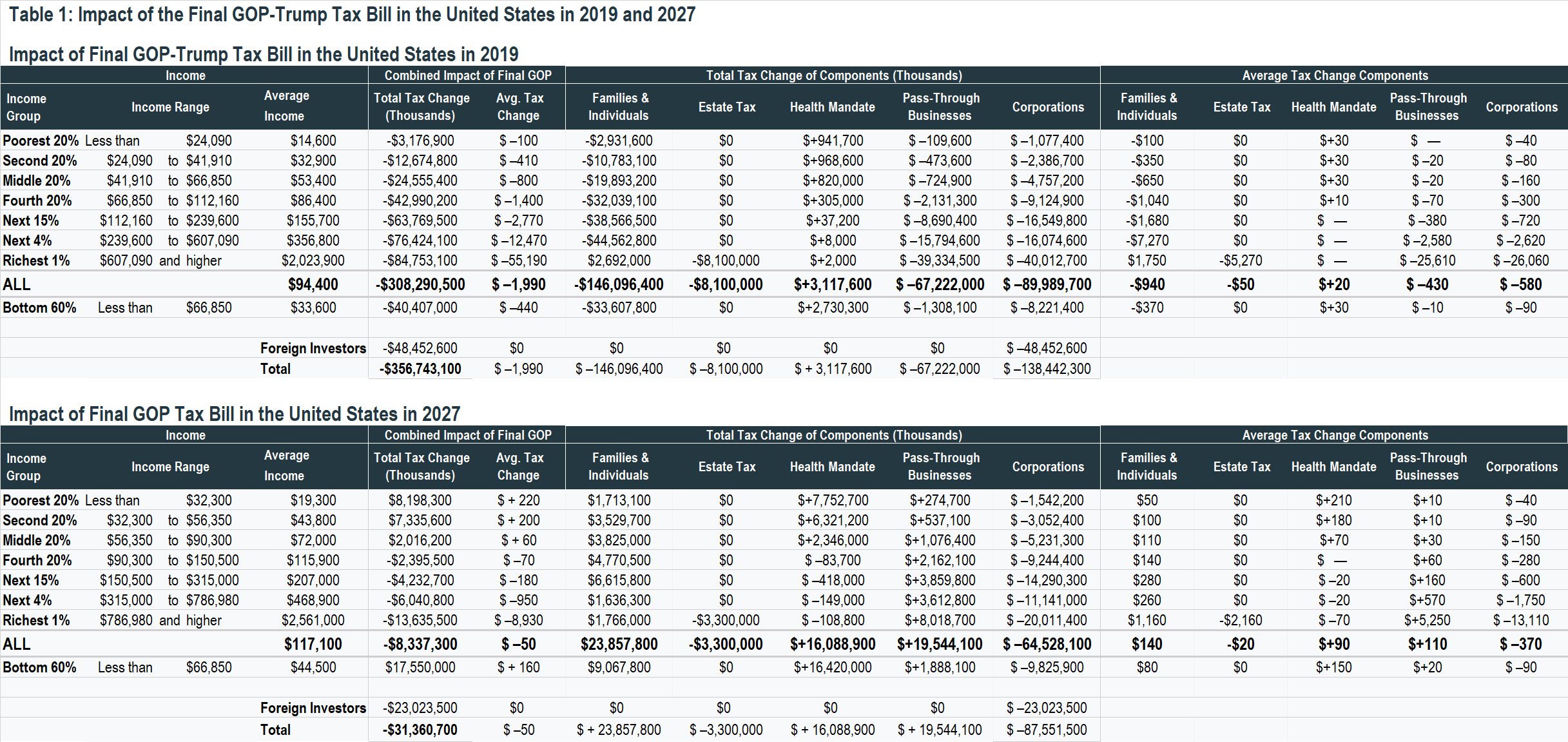

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Credit Com